Understanding Hybrid Long-Term Care Insurance

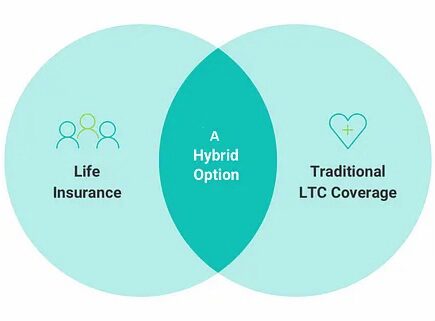

Hybrid Long Term Care Insurance is an innovative product combining the benefits of traditional long-term care with the advantages of a life insurance policy. It provides coverage for long-term care expenses while also offering a death benefit if long-term care is not needed. This type of insurance is designed to provide financial security and peace of mind for individuals who are concerned about the cost of long-term care in the future.

One of the key advantages of hybrid long-term care is the flexibility and control it offers over your investments. Unlike traditional long-term care policies, which typically do not provide any return on investment if long-term care is not needed, hybrid policies allow you to potentially recoup some or all of your premiums through the death benefit. Even if you never require long-term care, your policy will still financially benefit your loved ones.

One of the key advantages of hybrid long-term care is the flexibility and control it offers over your investments. Unlike traditional long-term care policies, which typically do not provide any return on investment if long-term care is not needed, hybrid policies allow you to potentially recoup some or all of your premiums through the death benefit. Even if you never require long-term care, your policy will still financially benefit your loved ones.

Advantages of Hybrid Long-Term Care Insurance

There are several advantages to choosing hybrid long-term care insurance over traditional long-term care insurance. First and foremost, hybrid policies provide flexibility and control that are not offered by traditional policies. With a hybrid policy, you can lock in your premiums for the life of the policy, giving you peace of mind knowing that your premiums won't increase unexpectedly.

Additionally, a hybrid long-term care policy typically offers more comprehensive coverage than traditional policies, including coverage for home health care and other types of long-term care services. This can provide greater financial security for those who may require more extensive long-term care in the future. Traditional long-term care policies often increase premiums over time, making it difficult to budget for the future. As we mentioned, hybrid policies allow you to lock in your premiums at a fixed rate, providing peace of mind and making planning for your long-term care needs easier.

Finally, hybrid policies often have more lenient underwriting requirements compared to traditional long-term care insurance. This means that individuals who may not qualify for traditional policies due to health conditions or other factors may still be able to secure coverage through a hybrid policy.

Additionally, a hybrid long-term care policy typically offers more comprehensive coverage than traditional policies, including coverage for home health care and other types of long-term care services. This can provide greater financial security for those who may require more extensive long-term care in the future. Traditional long-term care policies often increase premiums over time, making it difficult to budget for the future. As we mentioned, hybrid policies allow you to lock in your premiums at a fixed rate, providing peace of mind and making planning for your long-term care needs easier.

Finally, hybrid policies often have more lenient underwriting requirements compared to traditional long-term care insurance. This means that individuals who may not qualify for traditional policies due to health conditions or other factors may still be able to secure coverage through a hybrid policy.

Comparison with traditional Long-Term Care Insurance

While hybrid long-term care and traditional long-term care provide coverage for long-term care expenses, there are some key differences between the two.

One of the main differences is how the policies are funded. Traditional long-term care policies are typically funded through annual premiums, while hybrid policies are funded through a combination of premiums and a cash value component. This cash value can be accessed for long-term care expenses or passed on as a death benefit if long-term care is not required.

Another difference is the potential for a return on investment. Traditional long-term care insurance policies do not provide any return on investment if long-term care is not needed. Hybrid policies, on the other hand, have the potential to provide a death benefit to your loved ones, even if you never require long-term care.

One of the main differences is how the policies are funded. Traditional long-term care policies are typically funded through annual premiums, while hybrid policies are funded through a combination of premiums and a cash value component. This cash value can be accessed for long-term care expenses or passed on as a death benefit if long-term care is not required.

Another difference is the potential for a return on investment. Traditional long-term care insurance policies do not provide any return on investment if long-term care is not needed. Hybrid policies, on the other hand, have the potential to provide a death benefit to your loved ones, even if you never require long-term care.

How Hybrid Long-Term Care Insurance works

Hybrid long-term care combines the benefits of traditional long-term care with the advantages of a life insurance policy. When you purchase a hybrid policy, you pay premiums that are used to fund the policy and provide coverage for long-term care expenses.

If you require long-term care, the policy will cover a predetermined time or up to a specified dollar amount. This coverage can help pay for expenses such as nursing home care, assisted living facilities, or in-home care services.

If you do not require long-term care, the policy will pay out a death benefit to your loved ones upon your passing. This death benefit can provide financial security for your family and help cover expenses such as funeral costs or outstanding debts.

It's important to note that the specifics of how a hybrid policy works can vary depending on the insurance company and the specific policy you choose. It's essential to carefully review the terms and conditions of any policy before making a purchase. With careful planning and consideration, you can secure your financial future and protect yourself against the rising costs of long-term care. Don't let the cost of long-term care catch you off guard; The Balaban Group is here to help you explore the advantages of hybrid long-term care today.

If you require long-term care, the policy will cover a predetermined time or up to a specified dollar amount. This coverage can help pay for expenses such as nursing home care, assisted living facilities, or in-home care services.

If you do not require long-term care, the policy will pay out a death benefit to your loved ones upon your passing. This death benefit can provide financial security for your family and help cover expenses such as funeral costs or outstanding debts.

It's important to note that the specifics of how a hybrid policy works can vary depending on the insurance company and the specific policy you choose. It's essential to carefully review the terms and conditions of any policy before making a purchase. With careful planning and consideration, you can secure your financial future and protect yourself against the rising costs of long-term care. Don't let the cost of long-term care catch you off guard; The Balaban Group is here to help you explore the advantages of hybrid long-term care today.